The collection was up 104.6% in July, adding 3.57 trillion in revenue.

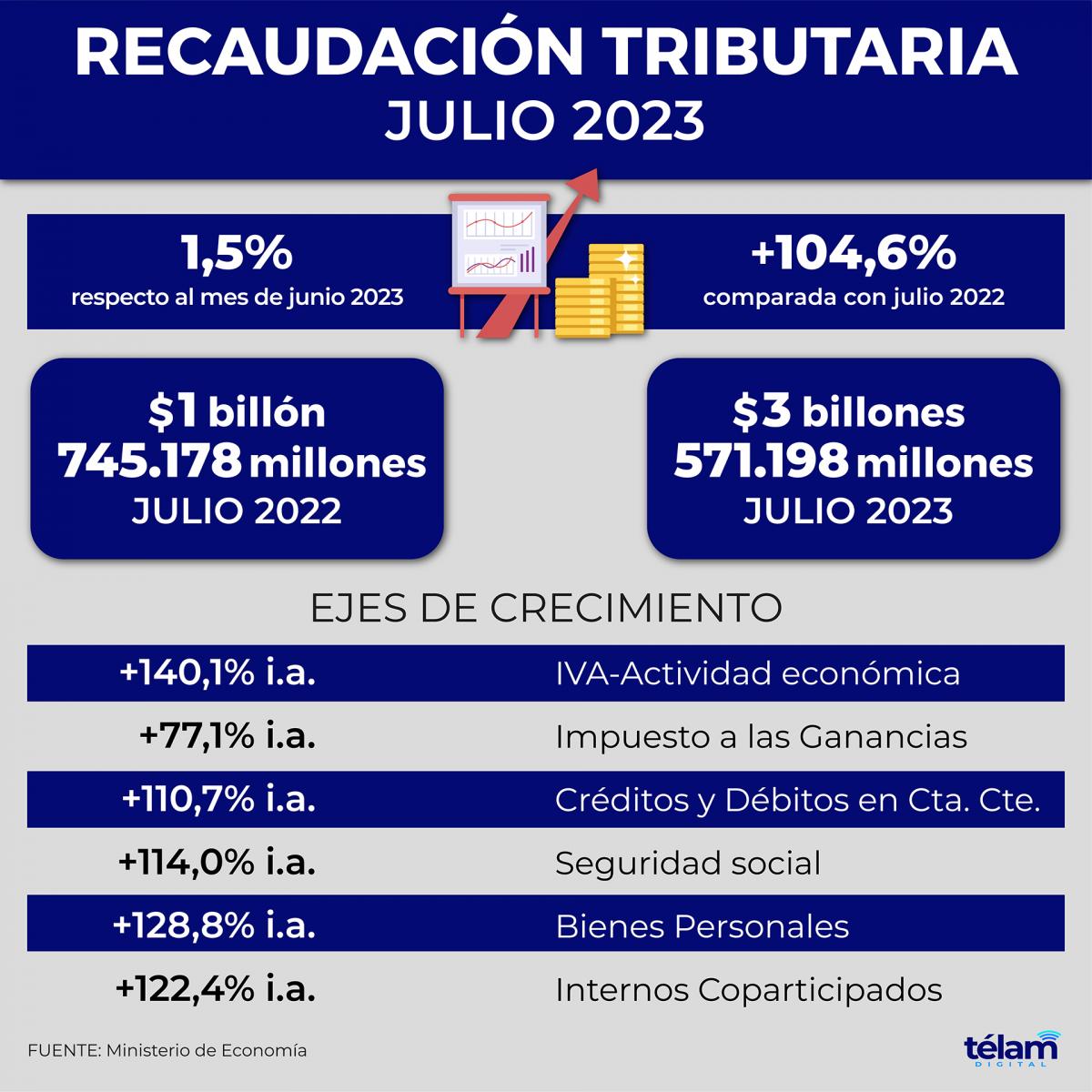

Tax collection rose 104.6 percent year-on-year in July and added $3.57 trillion in revenue amid drought and low commodity prices, the Federal Administration of Public Revenue (AFIP) said this afternoon.

As in previous months, The severe drought that hit the country in July once again affected earnings from export rights (DEX) or “deductions”, which fell 43.5% compared to the same month in 2022.

Apart from the effect of the drought, this variation is also explained by the decrease in the average prices of most products of the soybean and cereal complexes compared to the previous year.

Excluding DEX and fuel tax, collection would have increased by 116.7%, which is above the estimated price variation for the same period, AFIP said when it announced the month’s results.

In the case of the Fuel category, is a flat tax (this means that the amount per liter collected does not vary with price) which, due to a public policy decision, has delayed its update to avoid additional price impacts.

For the remainder of the first seven months of 2023, Tax collection amounted to 19.55 trillion. dollars, with an increase of 97.5% compared to the corresponding period last year.

The taxes that increased above the collection total were Personal Property (128.8%), VAT (127.3%), Domestic Shareholders (122.4%), Other Shareholders (117.7%), Social Security ( 114%) and Current Account Credits and Debits (110.7%).

The income generated by the Value Added Tax (VAT) in July exceeded one trillion pesos, reaching 1.17 trillion.an amount that implies an increase of 140.1% compared to the corresponding month last year.

In turn, VAT increased even more over the same period, with an increase of 155.9%.

As in previous months, the VAT collection shows the optimization of tax measures adopted by AFIP, which led this tax to show a significant monthly increase, the organization emphasized.

Some of these measures include improving the collection system for digital platforms as well as fiscal monitoring, among others, AFIP recalled.

While, Social Security resources increased by 127.2% due to the strong performance of employment and wage levels.

Amendments to the permanent plan, which provided for an advance payment for certain taxpayers entering the same month of accession, had a positive impact.

Total jobs rose 3.6% year-over-year, while average gross earnings rose 119.1% year-over-year, above the estimated increase in prices.

In addition, the interannual variation is positively affected by the exemption of 50% of Contributions for the health sector, due to the health emergency (in July 2022 the exemption of 100% of contributions for this sector was in force) and the differential Contributions applied to REPRO II beneficiaries in July 2022.

In turn, it is mitigated by the greater adherence to the current debt plan compared to 2022 ($93,513 million)

In the case of income tax, The collection reached $702,577 million, up 77.1% year-on-year. and totaled $4.2 trillion, up 84.8%.

The year-on-year variation was affected by the higher collection of withholding taxes.

In this sense, the increase in the rate to be applied to the perception of payments in foreign currency, which from 35% reached 45%, and the application of an additional rate of 25% to travel and expenses abroad for certain matters.

For his part, the so-called COUNTRY Tax, applied for foreign currency account and foreign exchange purchases, collected $65,539 million, with a year-to-date variation of 56.8%.

#collection #July #adding #trillion #revenue