Shein’s Brazilian clothing is better quality, but hidden on the site. see photos

Anyone who wants to know how the first batch of Brazilian clothing produced by Asian retailer Shein turned out should look closely.

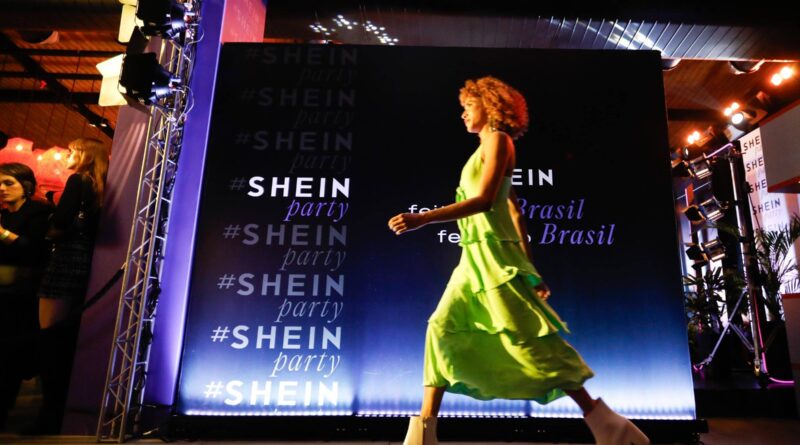

The women’s pieces from the spring-summer 2023/2024 collection, presented on Monday night (31) at an event in Sao Paulo, have yet to gain visibility on the platform.

“As we are a global player, we cannot privilege one particular segment, we have to value them all at the same time,” he said. Bed sheet Fabiana Magalhães, director of product and local production for Shein in the country, while showing the report that it is necessary to type “Shein Brasil” in the search area of the website or app to find the collection.

The selection consists of 800 pieces produced by around 110 Brazilian clothing companies, featuring national fabrics and local designers. On the website, they are identified as “She(In) Brasil; Envio Nacional”. Shipping time is about two weeks — half the average time for imported items.

The price range for the items ranges from R$20 to R$190. In general, the pieces are of a higher quality than the average imported products, which could be checked since last year in four temporary stores (pop-ups) opened by the company in the country (in Rio, São Paulo, Salvador and Belo Horizonte).

“We know that the national industry has very good stuff, of great quality. Shein didn’t come to Brazil for nothing,” said Fabiana.

In the collection, there are tops from R$19 to R$29, jeans from R$119, dresses from R$49 to R$129 and sets from R$185. In addition to denim, cotton and polyester, there are fabrics such as linen, laise and sequins.

“We’ve made a good choice, they’re not just pieces for the clubbing consumer. They’re also aimed at the more mature woman, in her 40s,” said Fabiana. But the price of the national piece remains competitive, because the company does not have the cost of shipping from Asia, he says.

For modeling, Shein made a mix between Chinese measurements (one of the country’s best-selling imports) and Brazilian measurements. “With this, we arrived at a Shein Brasil measurement table,” he said.

The goal, according to her, is to sell 2,000 pieces per month in the country. The goal is part of Shein’s commitment to the Brazilian government, announced on April 20, to invest R$750 million within three years, hire 2,000 factories in the country, and nationalize production.

“By the end of 2026, 85% of our sales will be products made in Brazil or sold by vendors [lojistas digitais] nationals,” he said Bed sheet Felipe Feistler, general manager of Shein in Brazil.

According to him, so far 170 factories have signed a contract with the Asian retailer, but only 110 are already producing to order – Shein’s winning business model, which uses artificial intelligence to scale production, does not hold inventory and adopts a zero waste goal. .

“Our production is for testing: we order 100, 200 pieces from the industries, integrated into our system, and we play them in the application. If the algorithm says that the models are going to sell, an already ordered service for the industries has been sent,” he said According to the executive, by the end of the year, 300 Brazilian factories will be integrated into Shein.

The company has already overtaken traditional fashion retailer Marisa in Brazil. Last year, according to estimates by investment bank BTG Pactual, Shein earned at least BRL 7 billion – a 250% jump from the BRL 2 billion recorded in 2021, according to BTG.

On the other hand, the gross revenue of Guararapes (owner of Riachuelo) reached R$8.6 billion and the gross revenue of C&A totaled R$8.2 billion. Last year, Renner continued to lead with ease: gross revenue of R$15.9 billion. But Marisa, with sales of R$3.2bn, has already been overtaken by the Asian, according to the bank’s estimates.

Competition for online clothing sales is fierce. According to consulting firm NielsenIQ EBit, in 2022, 72% of Brazilian internet users made purchases on foreign websites such as Shein, Shopee and Aliexpress. The fashion and accessories category is the most popular: it accounts for 4 out of 10 purchases on these sites.

As for the Federal Revenue’s Consignment Remittance program, which forces foreign sites to bill up front, charge taxes upfront, at the time the product is purchased, Fleistler says Shein is satisfied.

“That gets everybody on the same page, we’re looking at that very well,” says the Executive, noting that Shein was already considering nationalizing the production. “Only this year we accelerated the plans.”

#Sheins #Brazilian #clothing #quality #hidden #site #photos