The waiver for purchases of up to US$50 in e-commerce takes effect today

The measure named ‘Janjanomics’ will have an impact of BRL 35 billion by 2027 and is expected to reduce jobs

This Tuesday (August 1, 2023) the rule that allows foreign companies to export up to US$50 worth of goods to Brazil without paying federal taxes goes into effect. Known in Brasilia as “Janjanomics,” referring to the first lady, Janja, the measure will affect public accounts by BRL 35 billion from 2023 to 2027, according to Revenue. The CNI (National Confederation of Industry) has defended that the action will lead to 500,000 redundancies in the country by the end of 2023.

The IDV (Institute for Retail Development) is also against: “is preparing a wave of layoffs and store closures“. The expression “Janjanomics” is used to explain the zero rate, since the first lady defends this tax exemption.

Officially, the Consignment Remittance – as it is called – will have a zero interest rate for foreign companies which, according to national companies, will result in a competitive advantage over companies based in Brazil.

The Brazilian consumer will be able to buy international products at cheaper prices from various countries, mainly from China. The buyer will need to register with the Federal Revenue to carry out the operation, as well as companies from abroad. This process will allow the person to receive the shipment directly at home.

WHAT IS CHANGING?

The threshold price of $50 includes 17% ICMS (Goods and Services Tax), insurance and freight charges. Here is the full text of the decree (67 KB).

Currently, the import tax is 60% of the purchase price. For there to be an exemption, the companies they should join in the IRS Compliance Program. The company that does not register in the system continues to be charged with the tax. The goal is streamlining and greater control of operations.

For example, with the program, a product purchase of US$50 is subject to a 17% tax only from the government, which is US$8.5.

The same purchase without joining the new system will add 60% import tax, which would be USD 30 for this product. That is, the company would pay a total of US$38.50.

According to the newspaper Economic value, the Compliance Mission will take a few more weeks to take effect. This is because foreign e-sales platforms still need to qualify for the new system and the information needs to be analyzed by the Federal Revenue Service.

MORE INFORMATION

The government argues that the companies no longer paid taxes because they split the shipments into several packages that arrived in Brazil, as if they were sent by private individuals. Therefore, they avoided taxation. Therefore, they believe that the tax benefit for this type of consumption already existed.

Shopee, Shein and Aliexpress are among the companies that ship the most products to Brazil.

The ordinance will, according to the government, allow for more reliable data on buyers, exporters, products and people who resell. Nevertheless, the measure approved by the Minister of Finance, Fernando Haddad, may strengthen the purchases of foreign products. There will be a flight of money to other countries, without return to Brazil.

In practice, it will stimulate consumption, but with little impact on national economic activity. The minister is being pressured by industry and national retail to review the measure.

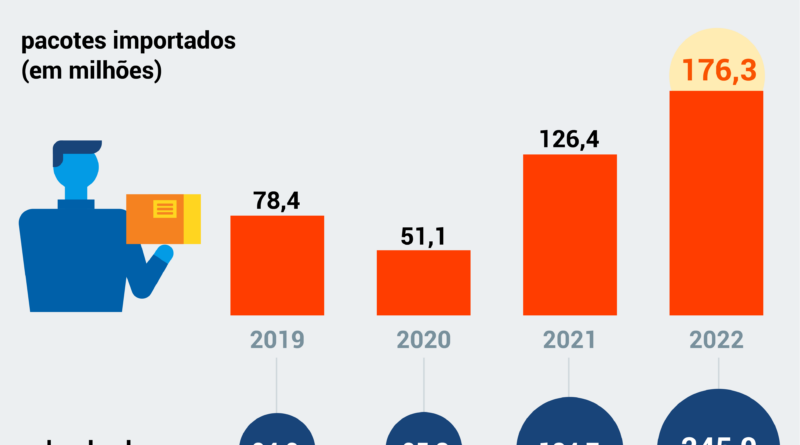

PACKAGES TO BRAZIL

Brazil received 176.3 million low-value parcels in 2022, which entered the country without paying any type of tax. Figures are from the IRS. The figure is 39.4% higher than that recorded in the same period in 2021.

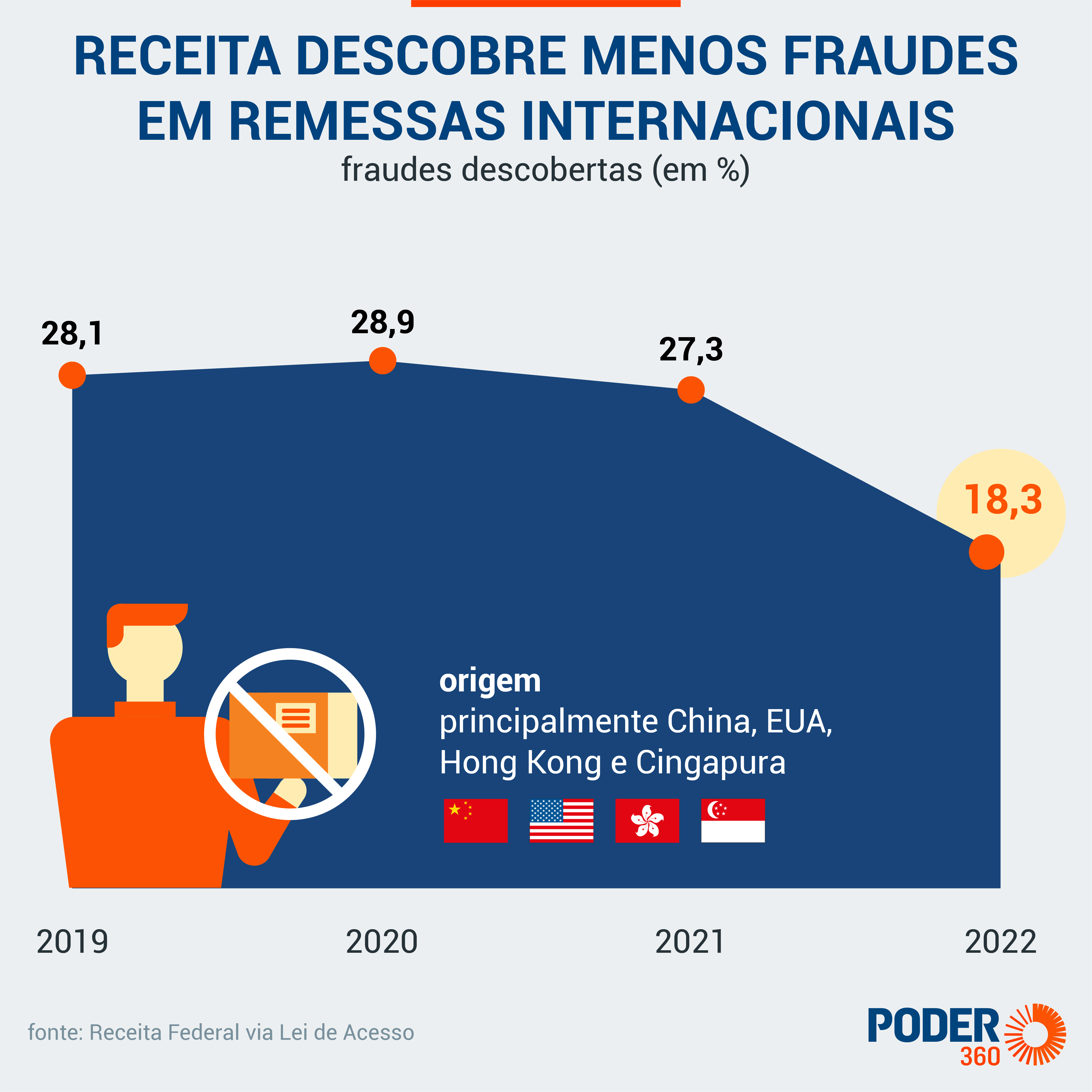

Federal Revenue discovered less fraud in 2022 in international remittances. Overall it was 18.3%. Origin is mainly from China, United States, Hong Kong and Singapore.

The 176.3 million products entering Brazil in 2022 cost US$245 million (about $1.16 billion). In practice, it equates to US$1.39 per product – the price of mineral water in a Brazilian airport.

Continue reading Poder360 the main reports on the e-commerce and taxation of imported products. Understand the debate on the topic in Brazil:

19 July 2023 – The Treasury will assess the impact of the zero rate on unemployment.

19 July 2023 – Zero input rate will cause 500k redundancies, CNI says.

19 July 2023 – Zero import rate to be revised, says IDV.

July 14, 2023 – Shein wants to nationalize 85% of sales by 2026, director says;

July 14, 2023 – Shein talks about meeting the new customs rules from August;

July 6, 2023 – At an event with Lula, the CNI criticizes the exemption for purchases of up to US$50;

June 30, 2023 – E-commerce companies are committed to design, says Haddad;

June 22, 2023 – States approve online shopping tax;

June 14, 2023 – The government must ensure fair competition in the country, says Alckmin;

June 9, 2023 – Haddad program will boost retail sales, Goldman Sachs says;

2.jun.2023 – States set ICMS at 17% for online purchases.

May 23, 2023 – Federal Revenue wants import tax paid at the time of purchase;

May 16, 2023 – 58% of Brazilians do not approve of the taxation of Shein and other sites;

May 13, 2023 – Digital retail fraud to reach BRL 87 billion in 2024, IDV projects.

May 10, 2023 – Haddad’s plan for Shein doesn’t avoid price hikes for consumers.

April 28, 2023 – States want a uniform process for taxing online purchases.

April 24, 2023 – Tax for Chinese website will be charged at purchase, says Haddad.

20.Apr.2023 – Haddad talks about “adjustment” plan for international orders;

20.Apr.2023 – Haddad says Shein will nationalize 85% of products in 4 years;

19.Apr.2023 – Keeping the $50 exemption worries us, IDV says;

April 18, 2023 – Lula waives R$8 billion and purchases of up to US$50 are tax-free.

April 14, 2034 – Consumer will pay tax on Shein and other sites.

13.Apr.2023 – The government confirms taxation on imported items up to US$50;

13.Apr.2023 – Understand the changes in shopping on international websites;

12.Apr.2023 – Farm says import exemption ‘never existed’;

12.Apr.2023 – Janja refutes post about taxation of imported products;

23 Mar. 2023 – Businessmen are calling for a change in the taxation of imports from China.

#waiver #purchases #US50 #ecommerce #takes #effect #today